Please notice all information provided by Qbridge is just for reference, the copyright and any other right of and in relation to which is solely owned by Qbridge or any other party it designates to. It is not allowed to use such information for profit, otherwise Qbridge reserves the right to pursue your liabilities.

By Liu Liu

Apply for 30 mins FREE Consulting!

Recently, Gamma data released the “2023 Year China Mobile Game Category Development Research Report”. The report analyzes the play methods and theme categories with remarkable market characteristics in recent years, such as sim, ARPG and fantasy, and summarizes the development status of various categories, user characteristics and market performance of representative products.

The report shows that in 2022, the scale of the modern mobile game market reached 34 billion, and the number of users reached 205 million; The scale of science fiction is 11.15 billion, and the number of users is 220 million; The scale of ARPG class reached 10.96 billion, and the number of users was 86.7 million; The scale of the fantasy class is 9.65 billion, and the user scale is 188 million; The scale of sim game class was 6.6 billion, and the number of users was 949 billion; The elimination game scale was 3.22 billion, and the user scale was 296 million.

The shooting play method of mobile game market accounted for 14.1%, and the modern theme accounted for 17.6%.

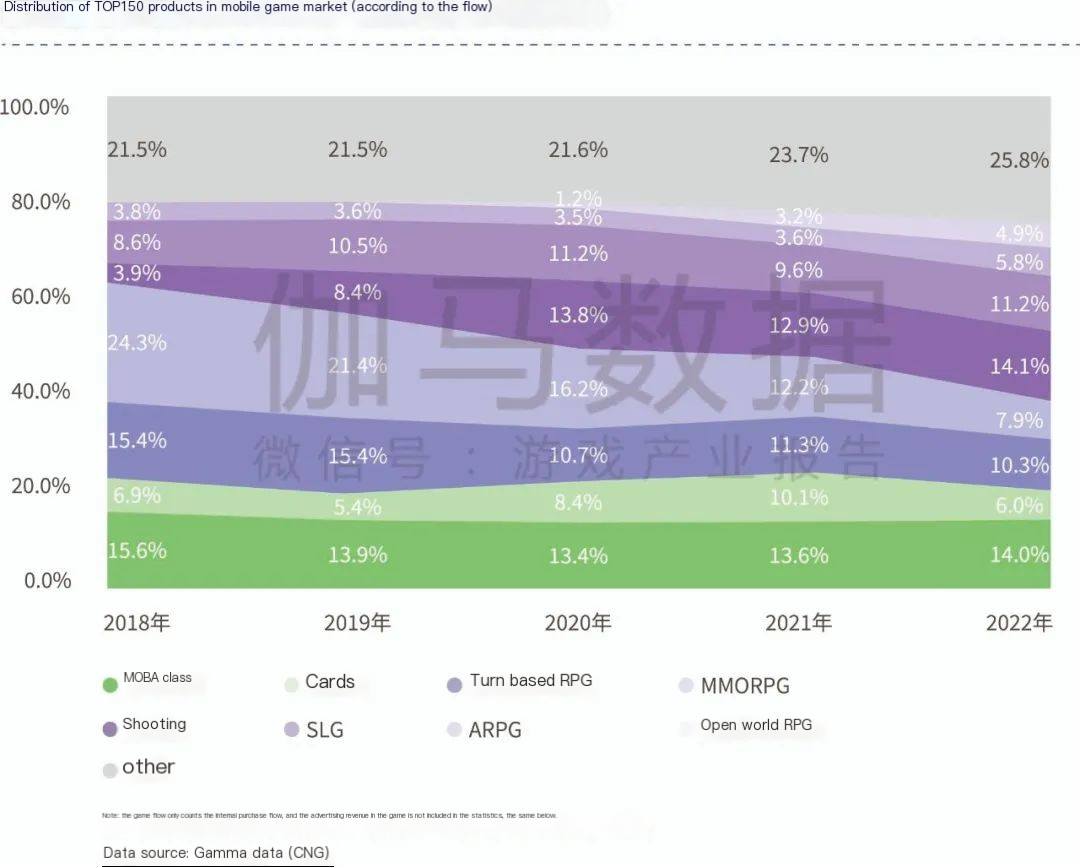

The China mobile game market has rich play methods and theme categories. With the development process, the market structure of categories is also changing. From the perspective of the play method of flowing TOP150 products, the market share of MMORPG (large multi person online role playing game) and turn based RPG has been significantly reduced, and the market share of shooting, SLG (simulation game), ARPG (action role playing game) and open world RPG games are showing a growth trend. In 2022, among the TOP150 products in the mobile game market, MOBA games accounted for 14%, card category accounted for 6%, turn based RPG category accounted for 10.3%, MMORPG category accounted for 7.9%, shooting category accounted for 14.1%, SLG category accounted for 11.2%, ARPG category accounted for 5.8%, open world RPG category accounted for 4.9%, and other category accounted for 25.8%.

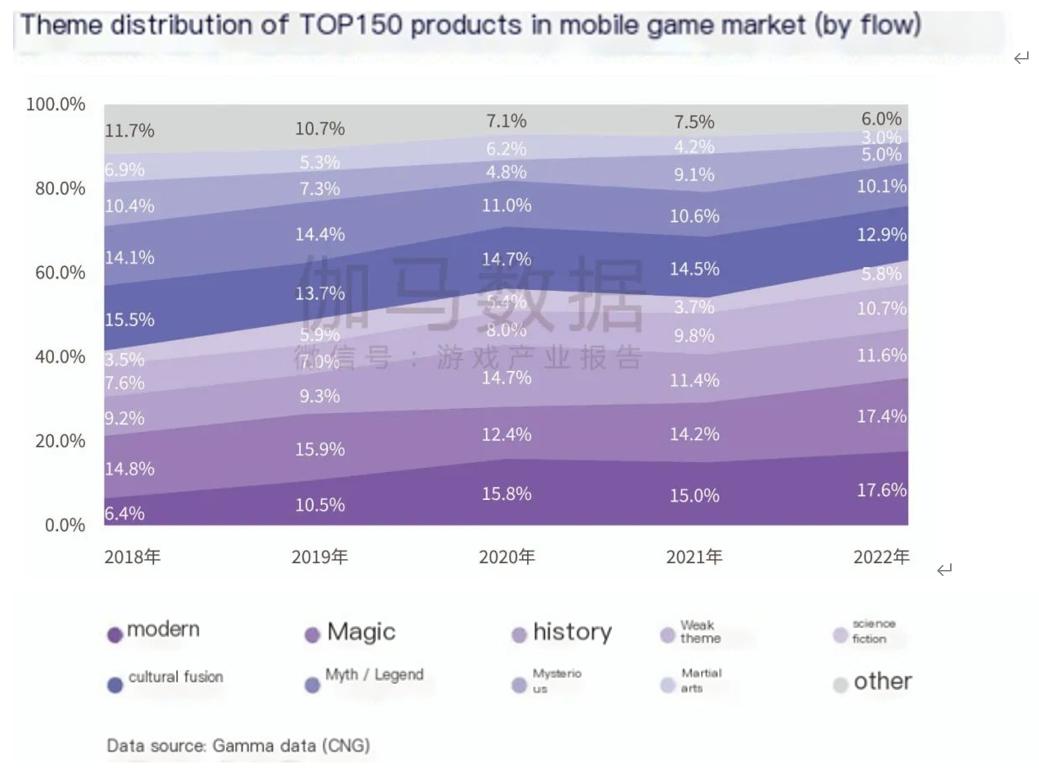

In terms of product themes, realistic themes and magic themes are the mainstream of the current market, accounting for 35% of the head market, historical themes account for 11.6%, weak themes account for 10.7%, science fiction themes account for 5.8%, cultural integration themes account for 12.9%, myth themes account for 10.1%, fantasy themes account for 5%, martial arts themes account for 3%, and other themes account for 6%.

The current user demand for shooting products is more significant. There are two main reasons why users are interested in but haven’t played related products. One is that users lack time and energy, and the other is that they haven’t found satisfactory products. These two groups have a large demand gap for shooting products, and this part of demand will become an important driving force for shooting products to continue to grow.

In terms of theme preference, fantasy has become the most popular theme category in the near future. With the spread of national culture and the promotion of head products, users’ attention to fantasy themes with more Chinese cultural characteristics has been improved, and there is still a large room for growth.

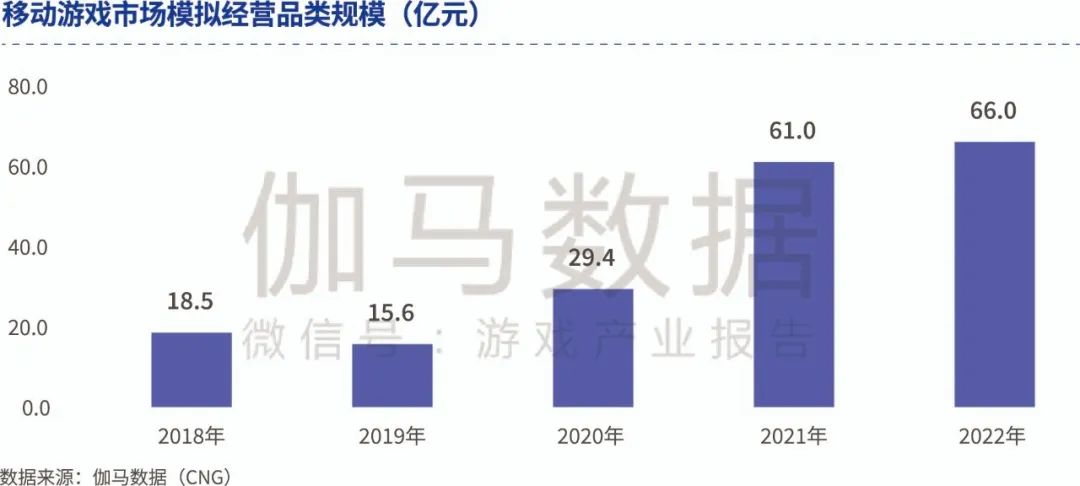

The scale of sim game class reached 6.6 billion, and the scale of elimination game category reached 3.22 billion.

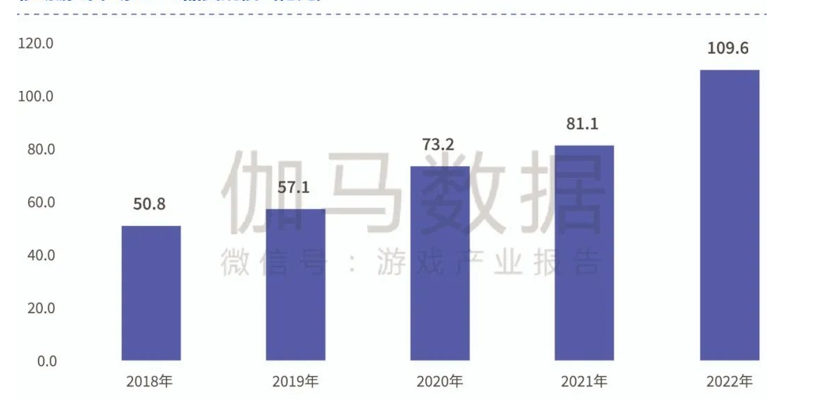

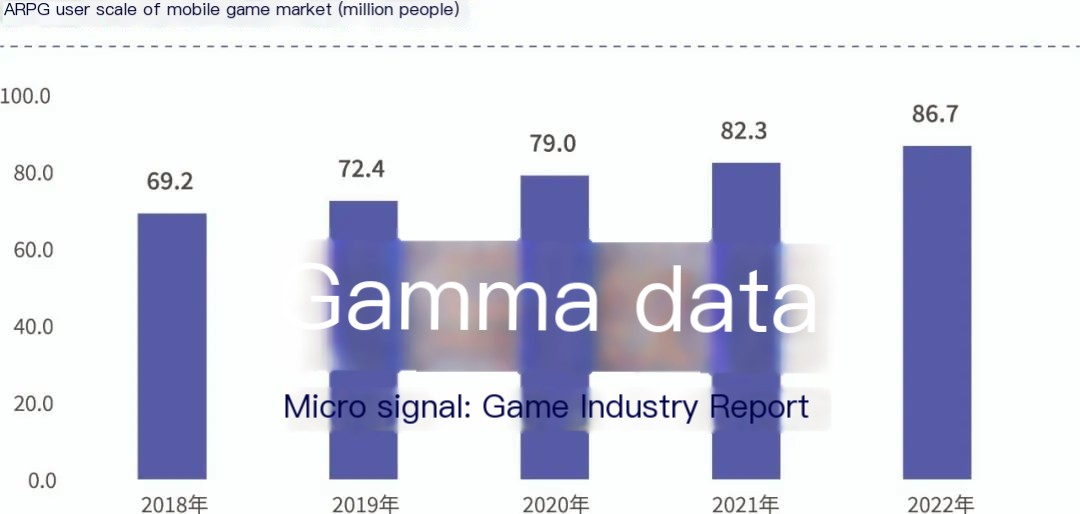

Among various kinds of play methods, the market and user scale of ARPG category has grown for five consecutive years, the category users are highly viscous and strong in consumption, and the market and user scale of ARPG category has continued to grow for five consecutive years. In 2022, the market scale reached 10.96 billion, and the user scale reached 86.7 million people. Among the current TOP10 ARPG products, 5 products have been operated for more than 3 years, of which 3 products have been operated for more than 5 years.

Scale of Mobile Game Market: ARPG (by 100 million RMB)

(Genshin is not included)

On the user side, more than 60% of ARPG category users are 20 to 29 years old, of which nearly half are students. Compared with middle-aged users, this part of users generally have more time and energy to invest in medium and heavy games, and have more stable consumption habits. The group consumption rate is close to 95%, and more than 40% of users spend between 100 yuan and 500 yuan per month.

The scale of sim game class also increased to 6.6 billion yuan in 2022. Since 2020, the sim game class have developed rapidly, and the market scale has expanded rapidly. In 2021, the scale of sim game class in the mobile game market increased from 2.94 billion to 6.1 billion. The continuous introduction of excellent new products is the main driving force for the growth of sim game class. By the end of 2022, 7 sim game products had entered the TOP150 mobile game running list of the year.

Sim Mobile Game Market Scale (by 100 million RMB)

In 2022, the number of sim game users in the China mobile game market reached 94.9 million. In terms of user attributes, the proportion of female users in sim game is more than 70%, and the consumption rate of female users is more than 90%.

Scale of Mobile Game of Sim Game (by million people)

In addition, the theme preferences of sim game users are more significant and diversified, which provides more opportunities for the development of each sub track under the sim game class. At present, the proportion of fantasy is the largest, reaching nearly 40%, followed by science fiction, history, magic, modern, two dimensional, martial arts and sports.

Preferred Themes for Sim Game Users

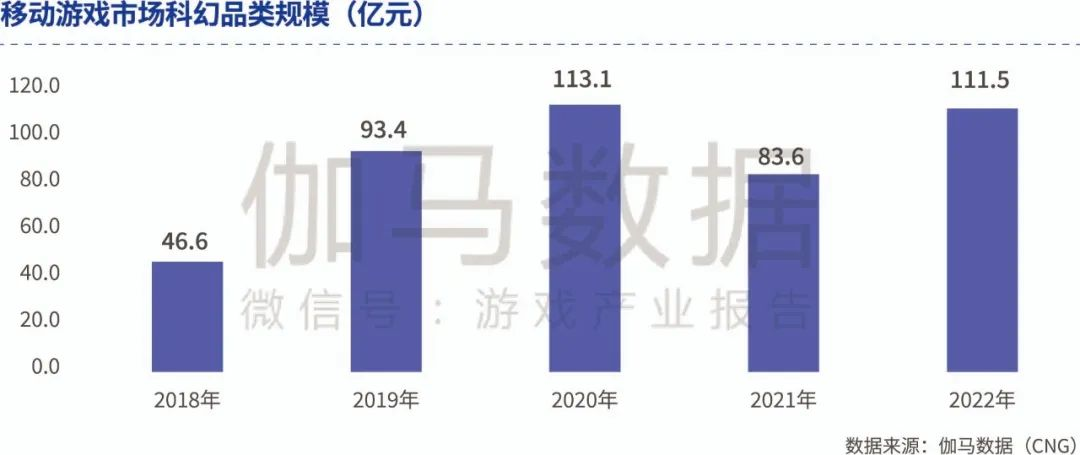

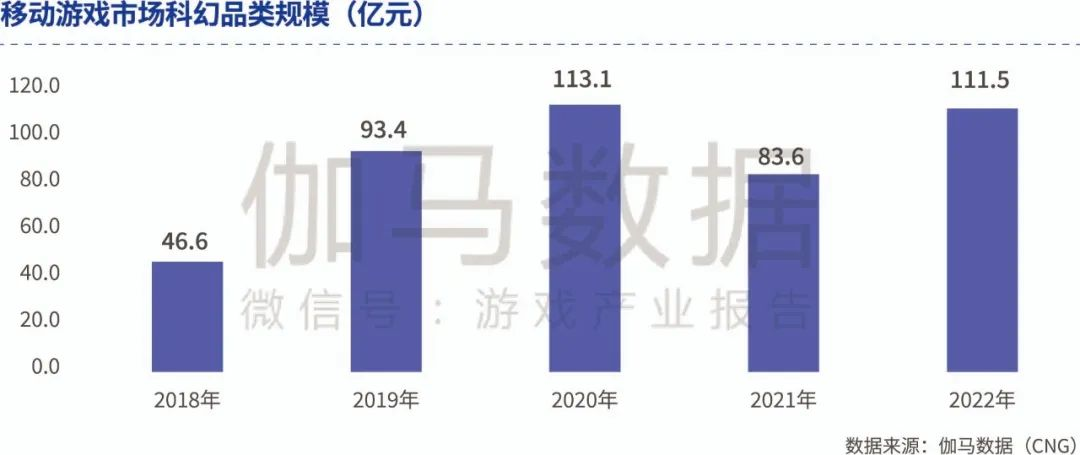

The market scale of fantasy category was 9.65 billion, the scale of science fiction category was 11.15 billion.

The market scale of elimination game category was adjusted to decline, and the game innovation could tap the user potential. In 2022, the scale of elimination game category in the mobile game market was reduced from 4.52 billion to 3.22 billion, excluding the impact of “residential economy”, and the scale of elimination game category market remained stable for a long time. In 2022, the elimination game head products were all products operated for more than five years, of which two products have been operated for nearly ten years. The long-term operation of the head products ensures the stable development of the market, but the new products of the category have not yet made a new breakthrough on the basis of the head products, and the innovation of the playing method will be an important thrust for the growth of the category.

Scale of the Market of Elimination Mobile Game (by 100 million RMB)

In recent years, the number of elimination game users in China has continued to decrease slightly. In 2022, the number of users was about 296 million, which is still one of the categories covering the most game users. The launch of innovative products is expected to quickly stimulate user vitality. About 70% of the elimination game user group are female users, and the overall age is distributed in double peaks, with the peak value located near 25 and 39 years old respectively. The average game consumption amount of users is mostly concentrated in the range of 30 to 100 yuan.

User Scale of Elimination Mobile Game (by million people)

The development potential of Chinese fantasy theme category is significant, and the overall consumption habits of users are stable. Under the China mobile game market, the market scale of Chinese fantasy products is declining. Although there was an explosive growth in 2021, the growth has not been consolidated. In 2022, the market scale was only 9.65 billion yuan.

Through the short-term growth in 2021, it can be seen that Chinese fantasy, as a theme developed from China’s local culture, has a high market acceptance in the China mobile game market, and its competitiveness in the theme dimension will also remain for a long time. With the landing of various enterprises in the layout of Chinese fantasy theme, the category is expected to achieve rapid growth.

The Market Scale of Mobile Game of Chinese Fantasy Theme (by 100 million RMB)

In 2022, the number of users of Chinese fantasy theme in the China mobile game market was about 188 million. With the decline of the market scale of Chinese fantasy theme, the user scale also began to decline naturally, but the user’s attention to Chinese fantasy theme remained high. In terms of user genders, the proportion of male users with Chinese fantasy themes is slightly higher than the overall average level of game users, and the proportion of 25 to 39 year olds is more than 60%, with a more stable game consumption ability.

Market Scale of Mobile Game of Chinese Fantasy Theme (by million people)

The play method of Chinese fantasy theme products in the front market is mainly MMORPG, accounting for 53.8%. Among other play methods, the war chess class accounts for 15.4%, the turn system RPG class accounts for 7.7%, the card class accounts for 15.4%, and the placement class accounts for 7.7%.

In 2022, the scale of science fiction category reached 11.15 billion, and the user’s shooting play preference was obvious. For a long time, the science fiction theme category of China mobile game market is mainly supported by small and medium-sized products, and there is a lack of revenue pillar products with long-term operation ability.

Market Scale of Mobile Game of Science Fiction Theme (by 100 million RMB)

In 2022, the number of category users reached 220 million, accounting for more than 30% of the total mobile users, and the user consumption capacity was high, and the market potential was huge. Among the users of science fiction category, male users account for about 60%, and the user age is evenly distributed between 20 and 40 years old. In terms of play preference, more than half of science fiction users said that they would pay more attention to shooting products, and the combination of science fiction and shooting might become the focus of the next stage of growth of science fiction category.

Users Scale of Mobile Game of Science Fiction Theme (by million people)

In terms of product structure, in 2022, the TOP10 products of science fiction category, the proportion of Anime and Manga and light science fiction themes was 48.8%, the proportion of hard core science fiction was 27.9%, and the proportion of end of life themes was 23.3%. It is worth noting that the proportion of hard core science fiction themes in gross revenue is significantly higher than that in 2021.

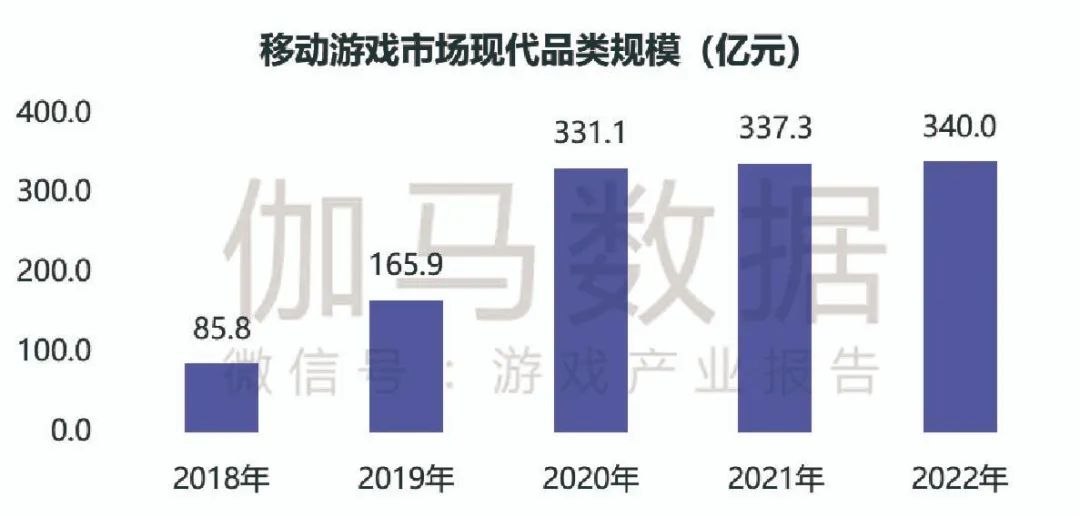

Shooting plays promote the rapid growth of modern themes, covering two categories of differentiated users. In 2019, with the release of new products with modern themes such as Game for Peace, the market scale of modern category in the mobile game market was rapidly expanded. In 2022, the scale of category reached 34 billion, an increase of nearly three times in five years.

Market Scale of Mobile Game of Modern Themes (by 100 million RMB)

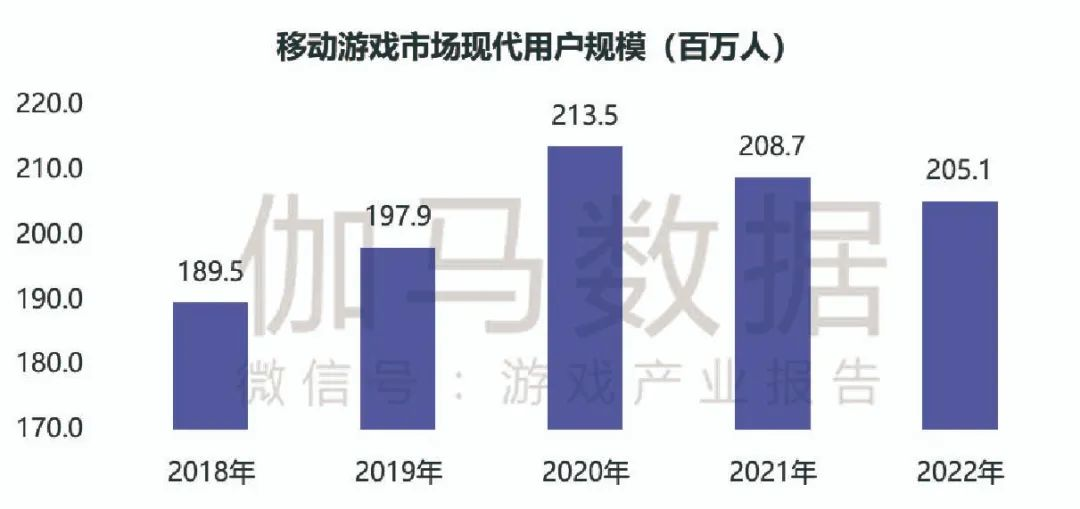

In 2022, the number of users with modern themes dropped by 1.7% to 205 million. The users of modern theme category are composed of two user groups. One is the user group based on male users attracted by shooting products. The consumption willingness of this part of user groups is stable, and the monthly consumption amount is concentrated in the range of 100 yuan to 500 yuan; the other part is based on the users of light game category such as leisure, dressing and sim business. This part of users are mainly women, and the monthly consumption is concentrated in the range of 30 yuan to 100 yuan. It is worth noting that the payment rate of the two groups is similar, and the proportion of paying users is less than 90%.

User Scale of the Mobile Game of Modern Themes (by million people)

Under modern themes, in addition to shooting games, there are also leisure category accounting for 22.15%, sim game category accounting for 12.77%, dressing category accounting for 14.96%, asymmetric competitive category accounting for 12.76%, story interaction category accounting for 12.69%, strategy category accounting for 8.22%, racing category accounting for 6.52%, card category accounting for 6.24%, and elimination category accounting for 3.68%.

Under the current game market environment, it is increasingly necessary to explore the development possibilities of various categories of mobile games. Strengthening the diversified layout has become a choice for some game enterprises. The integration of categories can also provide new ideas for development, and the integration of multiple play methods can effectively improve the playability of the game. The innovation of themes in mobile games will enhance the development potential, independent mobile games will greatly promote the development of game categories, and the vigorous issuance of enterprises will also help the growth of independent games.

Get more information tailored to your needs by click Here.