Please notice all information provided by Qbridge is just for reference, the copyright and any other right of and in relation to which is solely owned by Qbridge or any other party it designates to. It is not allowed to use such information for profit, otherwise Qbridge reserves the right to pursue your liabilities.

By Little SOMO from CGSOMO

Apply for 30 mins FREE Consulting!

China’s game market has been hot for a long time, but everything is easy to change. Today, let’s see the situation and trend of China’s market based on facts and data.

Let’s first talk about some characteristics of the Chinese game market:

- One of the largest game industries in the world (with a revenue of US $45.5 billion in 2022);

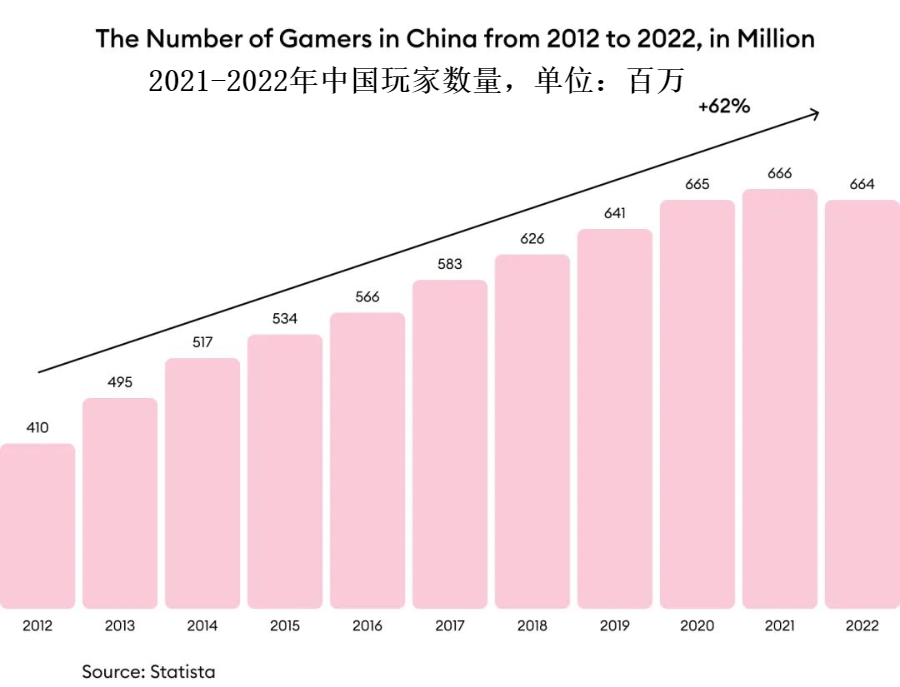

- It has a large number of game players (664 million in 2022), which is expected to increase to 730 million (an increase of about 10%) by 2027;

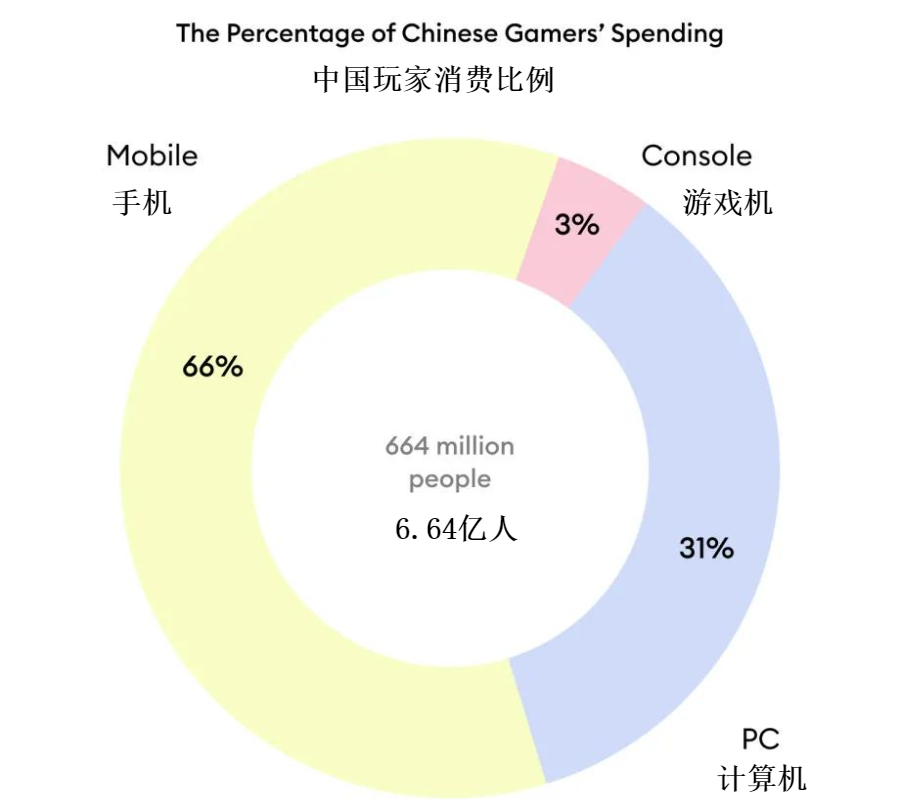

- Mobile games and computer games are the most popular game categories; They bring the highest share of income globally (47% and 39% respectively);

- F2P cash flow is popular among Chinese game developers, and players are used to this mode because of previous restrictions and economic conditions;

- The high-quality monetization model is not universal, but it is more and more popular.

- Chinese Games

In 2022, China’s game market revenue (including mobile phones, computers and game console games) increased to US $45.5 billion. It is expected that by 2027, the number will increase by 25% (US $57 billion).

Although the population of our country is decreasing, but the game players can rise all the time. From 2012 to 2,021, the number increased by 62.5%. But in 2022, the number slightly decreased by 1% over the previous year. (most likely, it is related to the game restrictions of children’s brothers and sisters, which can only play one hour of games from 8 to 9 p.m. on Friday, weekends and holidays.) however, experts said: it is expected that by 2027, the number of players will increase to 730 million.

At present, 46% of the population are playing video games, including 300 million women. The average age of Chinese players is 35 years old, and the ARPU (average income per user) is 64 US dollars.

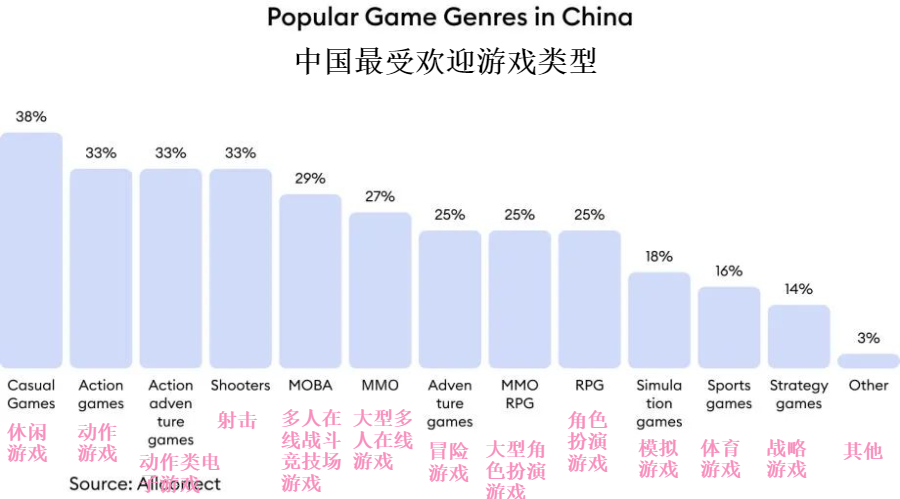

The most popular game type among Chinese players:

It’s not hard to find from the chart below that the most popular game type is mobile games, and 66% of players spend money on mobile games.

The following is a schematic diagram of domestic game market revenue divided by user consumption:

Now let’s have a detailed understanding.

- The dominance of mobile games: 47% of global revenue

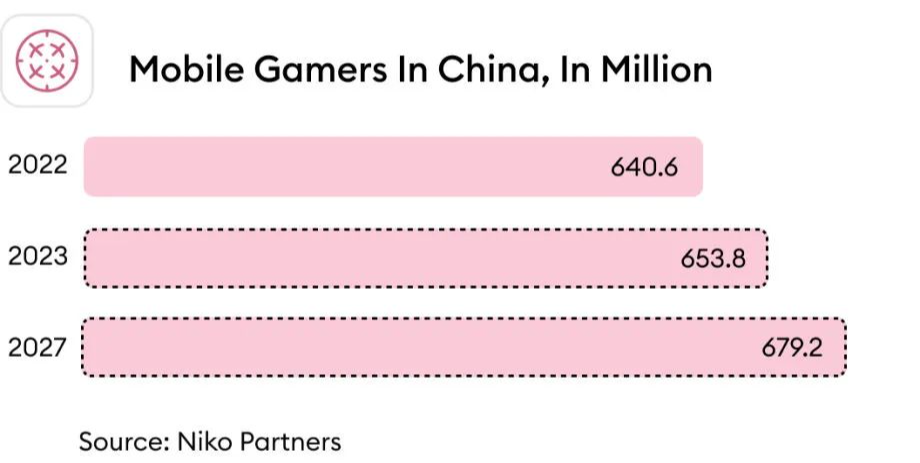

Chinese game studios have players all over the world, accounting for 47% of global mobile game revenue. In addition, 38 China Mobile game publishers entered the top 100 in the global mobile game manufacturers’ income list. In the domestic market, the mobile game revenue in 2022 was US $30.1 billion.

(income of mobile games in China)

(Chinese mobile game players, unit: million)

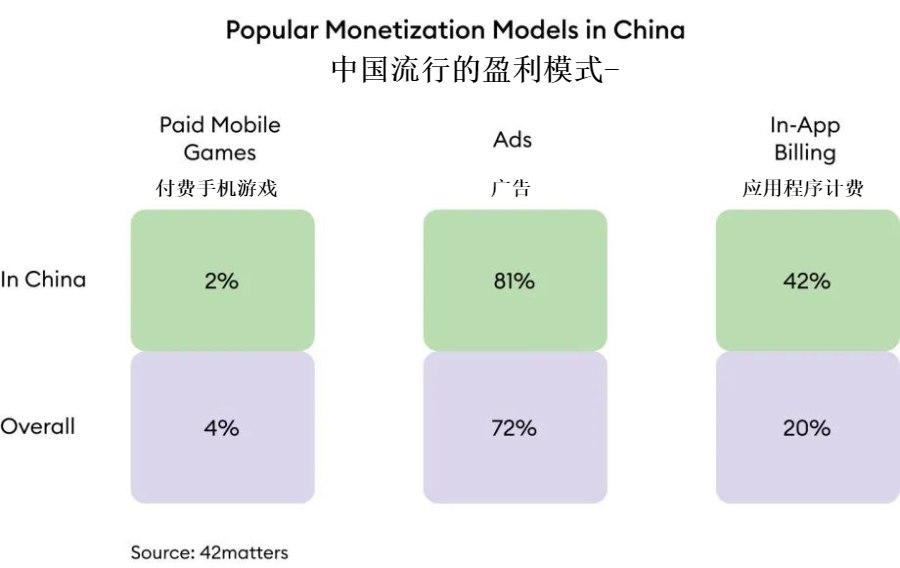

The profit models used by China Mobile developers are as follows:

- PC and game machine: 39% of global revenue

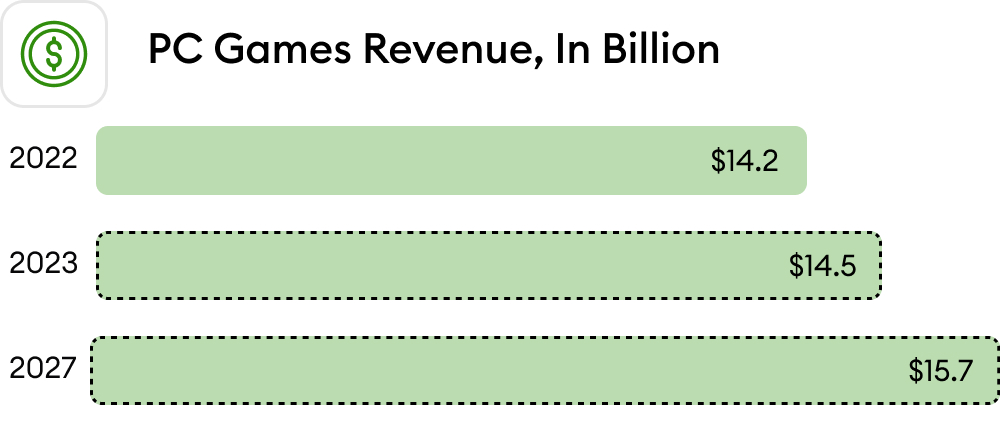

Chinese computer games are also very popular in the world: they account for 39% of the global computer game revenue. As for the domestic market revenue, it was US $14.2 billion in 2022.

(PC game revenue, unit: 100 million)

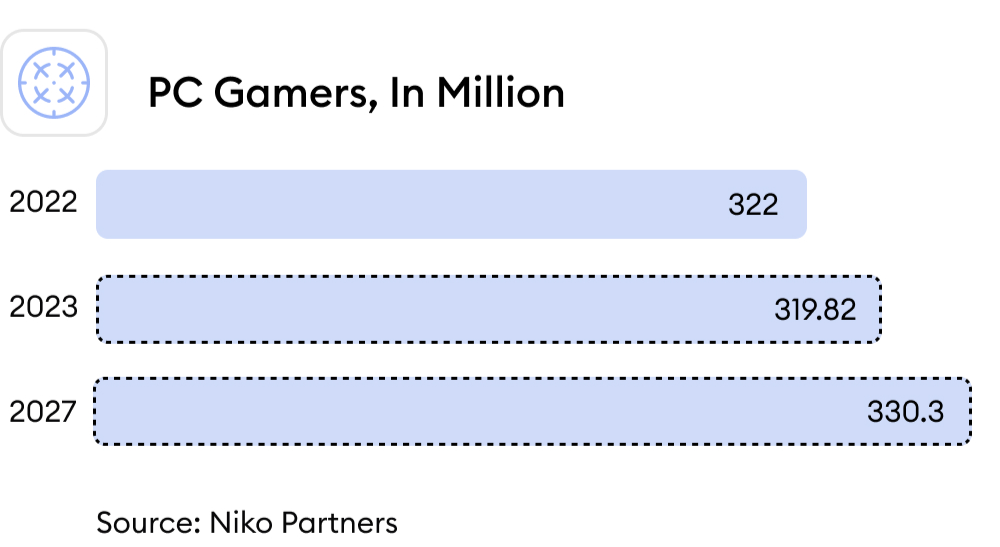

(PC games, unit: million)

In 2022, the overseas PC game revenue of Chinese enterprises increased by 22%, and it is expected that the compound annual growth rate will reach 13.8% by 2027, significantly higher than the domestic growth rate.

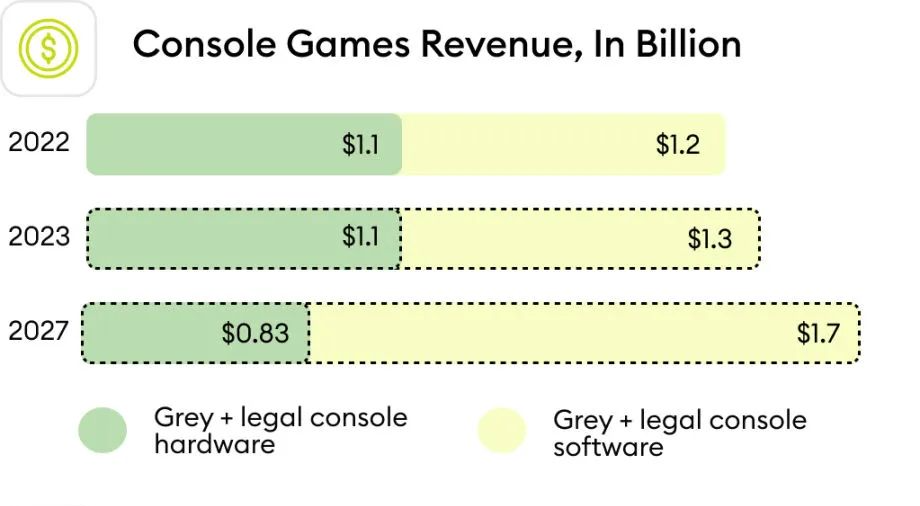

In 2022, the market value of domestic console games was US $2.29 billion, an increase of 7.8% over the previous year

- Two giants of game development

- The game industry is represented by Tencent, NetEase and other. The two world giants brought the highest proportion of all game revenue to China.

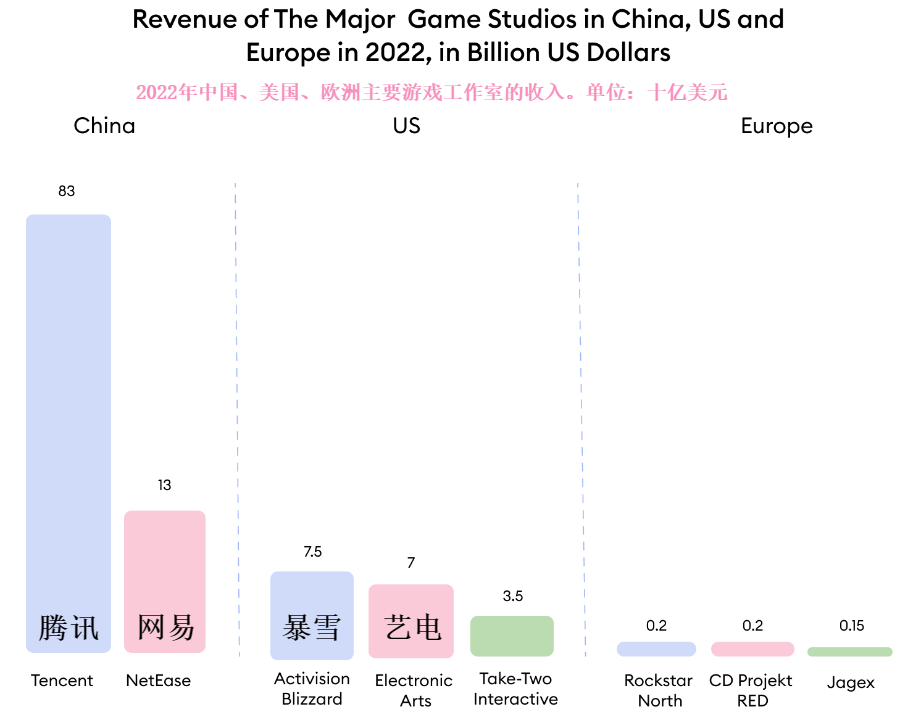

- Chinese companies Tencent and NetEase are in a leading position among other studios in the world: their income is dozens of times higher than that of many major game companies in the United States and Europe. Therefore, China’s game revenue is concentrated in the two giants, while in other countries, the game revenue is more distributed in the whole market.

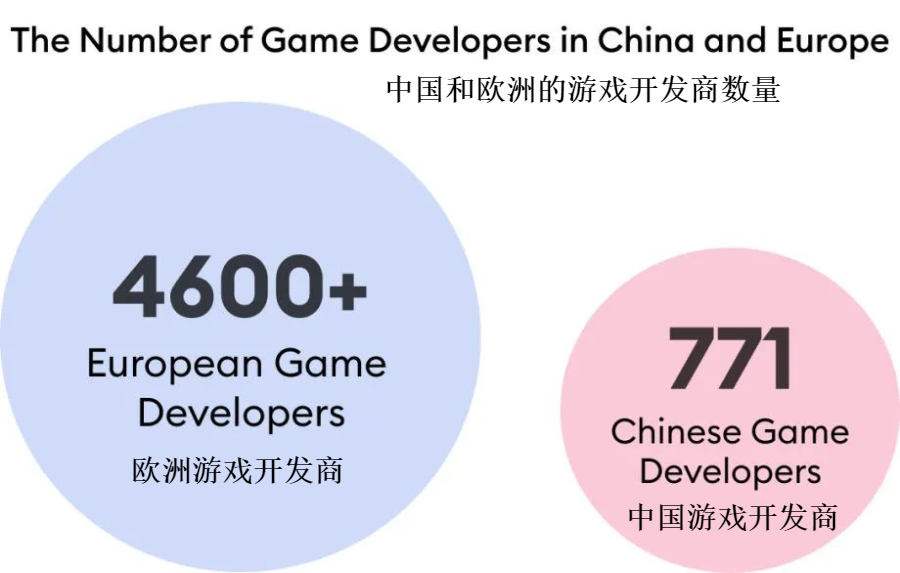

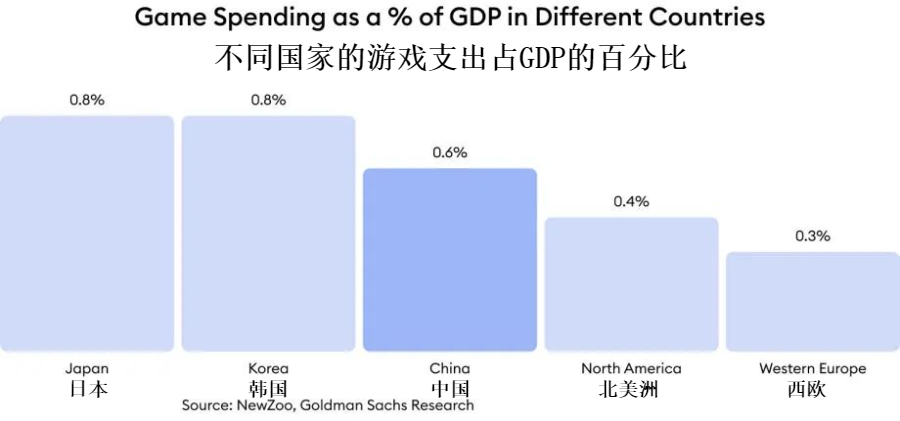

- Compared with the United States and Europe, the number of game studios in China is much smaller, but the proportion of China’s game spending to GDP is higher than that of western countries. However, China ranked third, lagging behind other Asian countries such as Japan and South Korea.

- Due to the restrictions of the Chinese government, game developers began to issue fewer games, and foreign studios were unable to promote their game projects to the Chinese market. However, with the lifting of the import ban, the trend is expected to decline. In 2023, the number of authorized games is likely to be more than in 2021 and 2,022.

China’s game development market is characterized by two Monopolies: Tencent and NetEase, which account for 61% of the market share and bring more than 80% of China’s game revenue. At the same time, they are also important international players and have achieved good results in global game sales.

Tencent: from 2012 to 2021, the revenue increased by 13 times. However, in 2022, there was a slight decrease of 5.08%, which was about 82 billion yuan in domestic and foreign markets.

NetEase: from 2009 to 2022, its revenue has been growing. It has increased by about 26 times. By 2022, the revenue of domestic and foreign markets will increase to 13 billion US dollars.

It is worth mentioning that there are 771 game companies in the country. In addition to Tencent and NetEase, China’s game development market has also brought huge profits to the following game developers:

Due to the decrease in the number of game players, the slow release of new games and the decrease in the income of existing game projects, the income of most game companies in the first 3 months of 2023 was reduced. The main reason for this phenomenon is the game restrictions on asking adults. In addition, the 18 month import ban ended at the end of 2022. Therefore, last year, China only approved 44 imported games suitable for the domestic market. As for the domestic game market, a total of 468 video games were licensed in 2022.

However, the prediction of game distribution is optimistic. It is predicted that in 2023, China will approve more than 1,000 domestic games and more than 100 imported games, which will exceed the number of Games launched in 2021 and 2022.

There are 4,600 game development studios in the European game industry, and the revenue will reach US $30 billion in 2022. Among them, the UK, Germany and France have the highest income!

Although in terms of total income, China’s market is not as good as the U.S. game industry, due to the different living standards of these countries, it is very important to compare the market within the framework of the proportion of game expenditure to GDP. In this case, the performance of Asian Games is better than that of the US and European markets. In addition, China is likely to catch up with other Asian countries such as Japan and South Korea.

The above is the situation and trend of China’s game market! Although China’s industry started late, it is developing at a speed visible to the naked eye. At the same time, under the background of national entertainment, the game industry continues to usher in good opportunities for development, and the market pattern is increasingly stable!

Get more information tailored to your needs by click Here.