Apply for 30 mins FREE Consulting!

01

Basic Concepts

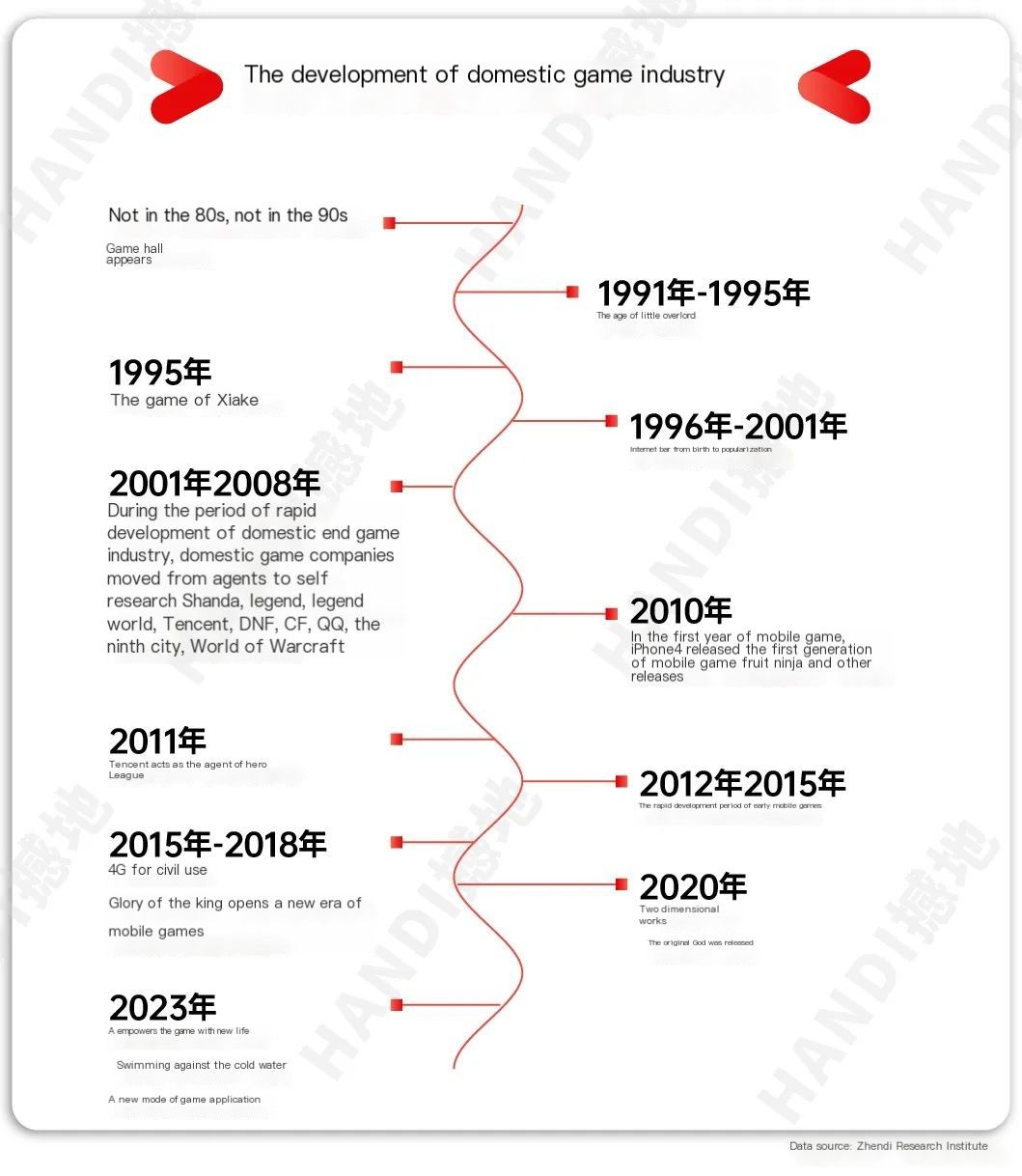

From red and white machines, game halls, Internet cafes to mobile devices such as mobile phones, electronic games as an entertainment consumer goods, with the increasingly strong network economy, are now quite an important part of the entertainment industry.

If divided by product type, electronic games can be divided into PC games, mobile games and games of special game devices. Among them, PC games are divided into console games and online games, and online games are divided into client software games, web games and social games.

Electronic games have a wide audience base, involving the development, operation, sales and other fields of video games, and forming its own industrial chain.

China’s game industry started late, but developed rapidly, and has made good achievements from game agent to self research. The popularity of game products such as Rhythm Master, Arena Of Valor, Honkai Impact, Genshin and Justice Online mark the beginning of China’s leading role of mobile game era.

02

Market Size

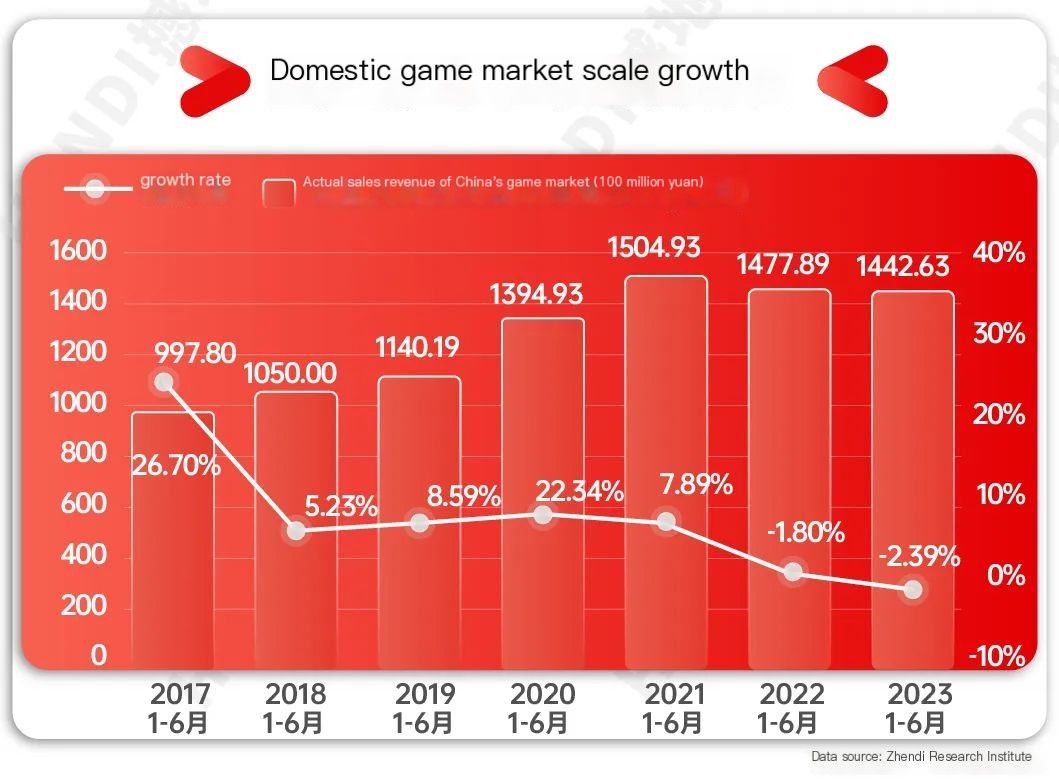

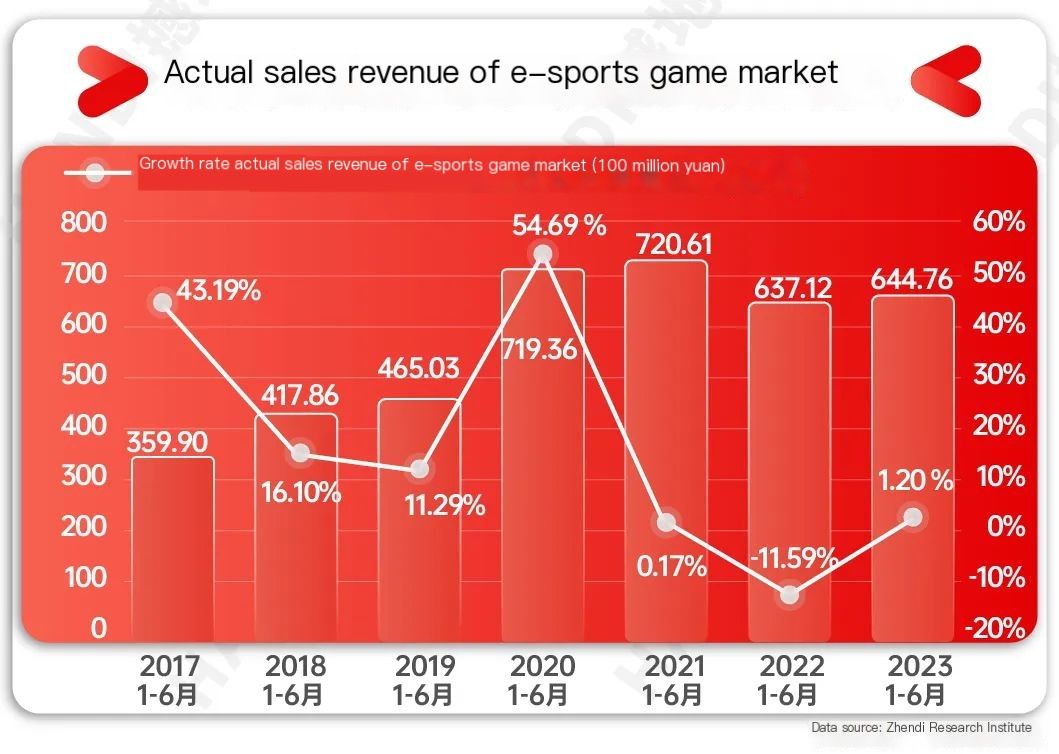

After years of development, China has become the largest game market in the world. In 2022, the market scale reached 265.884 billion, reaching 1/4 of the global market.

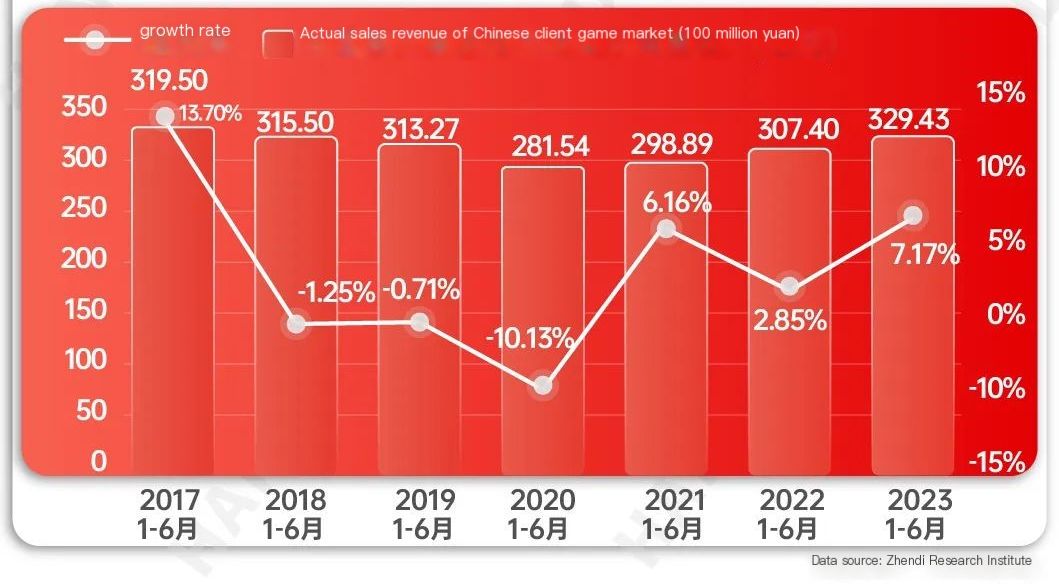

In the first half of 2023, the actual sales revenue of China’s game market was 144.263 billion yuan, of which the actual sales revenue of mobile games accounted for 73.97%. In the past 3 years, the proportion of mobile games in China’s overall game market was stable at about 75%, which is the absolute core of domestic game market revenue. It is estimated that in 2023, the Chinese game market will reach 300 billion yuan.

The Income Growth of Mobile Game:

The Income Growth of Client Software Game:

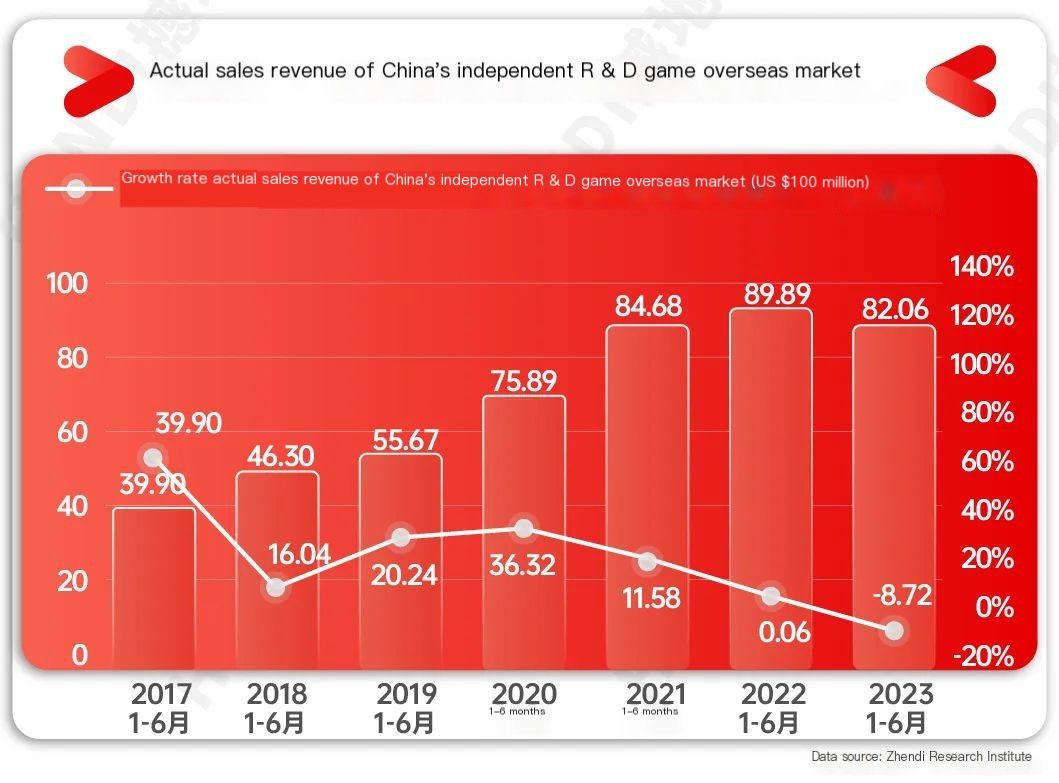

The United States, Japan and South Korea are the main overseas markets of China Mobile games, accounting for 31.77%, 19.65% and 8.50% respectively. In recent years, from overseas emerging markets such as the Middle East, Latin America and Southeast Asia, the growth momentum is obvious.

03

Analysis of Industrial Chain

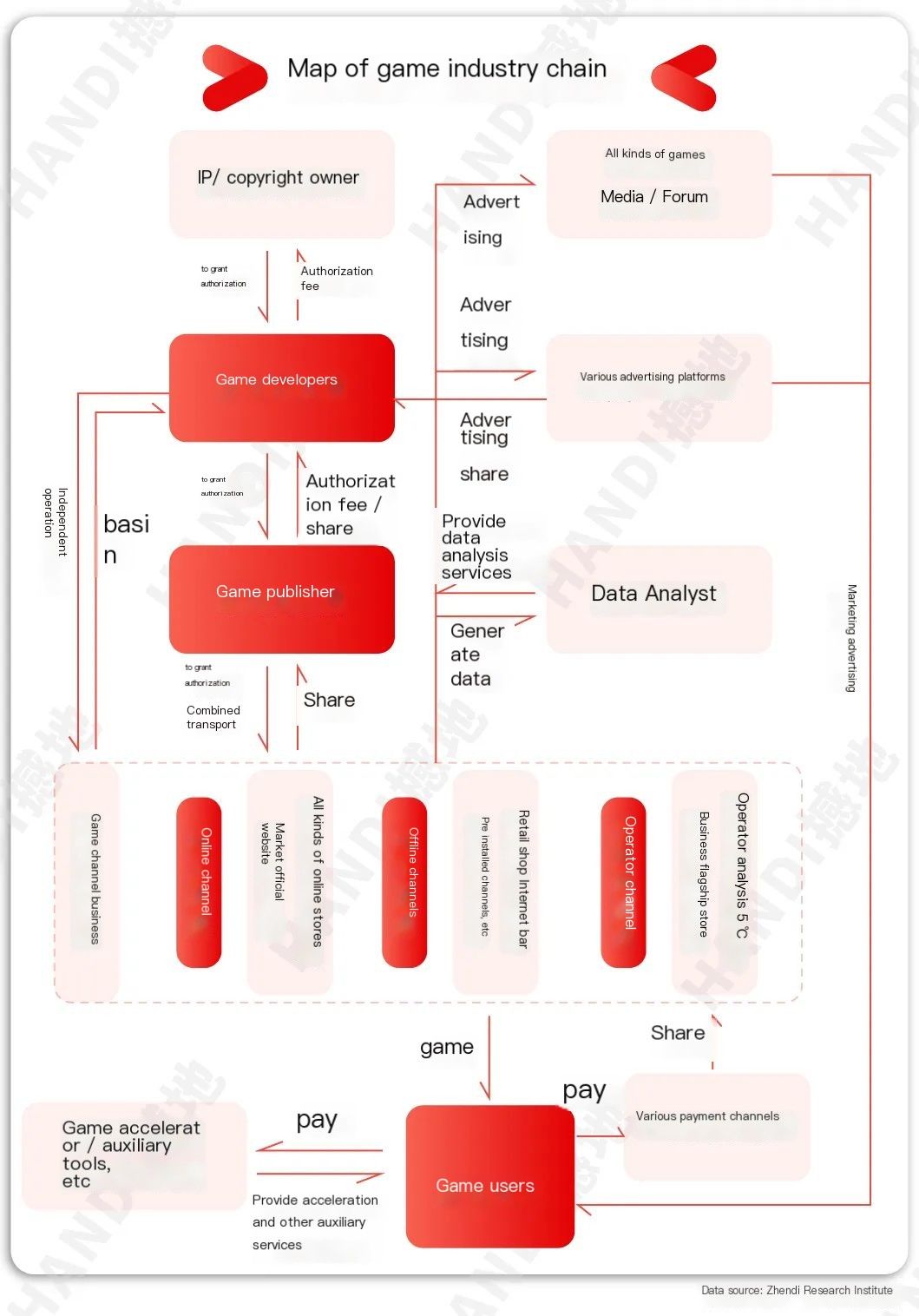

The game industry chain is mainly composed of upstream game developers, publishers, middle channel distributors and downstream end users.

Upstream game developers are responsible for game development and production, and publishers are responsible for game modification and update, activity operation, and market launch. Game developers with small scale and no rich experience in distribution and operation mostly focus on game development, while top manufacturers such as Tencent, NetEase and 37 Mutual Entertainment adopt the business model of “developing and publishing integration”.

Midstream channel distributors have a high bargaining power in the industrial chain, which can be divided into three channels: online, offline and operator. The distribution channels mainly include the official hardware store (HUAWEI, Xiaomi and other application stores), the third party App Store (Tencent app store, app store, etc.), the super APP (TikTok, Sina Weibo, WeChat, etc.), the advertising platform and the vertical community platform.

04

Key Enterprises

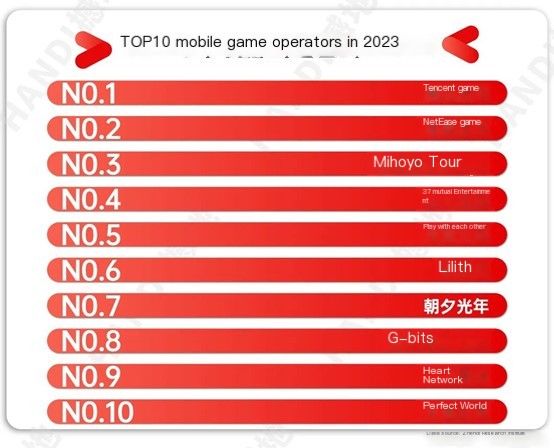

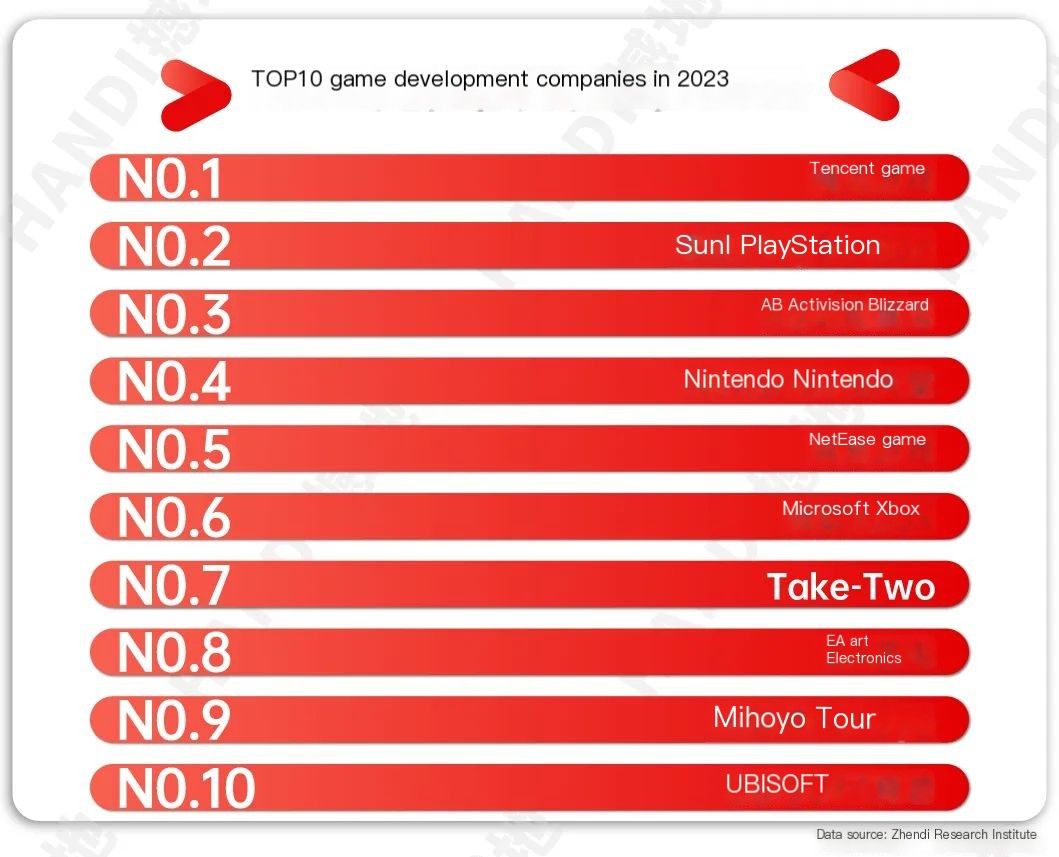

In the Chinese market, Tencent and NetEase account for more than 70% of the market share, especially Tencent games, relying on the competitive advantage of social ecology, through a combination of self-research, agency and acquisition, launched national level popular mobile games Arena Of Valor and Game for Peace to occupy the first place. In 2020, the industry dark horse miHOYO tour became the leading enterprise in the industry by virtue of game works such as Genshin and Honkai Impact.

05

Relevant Policies

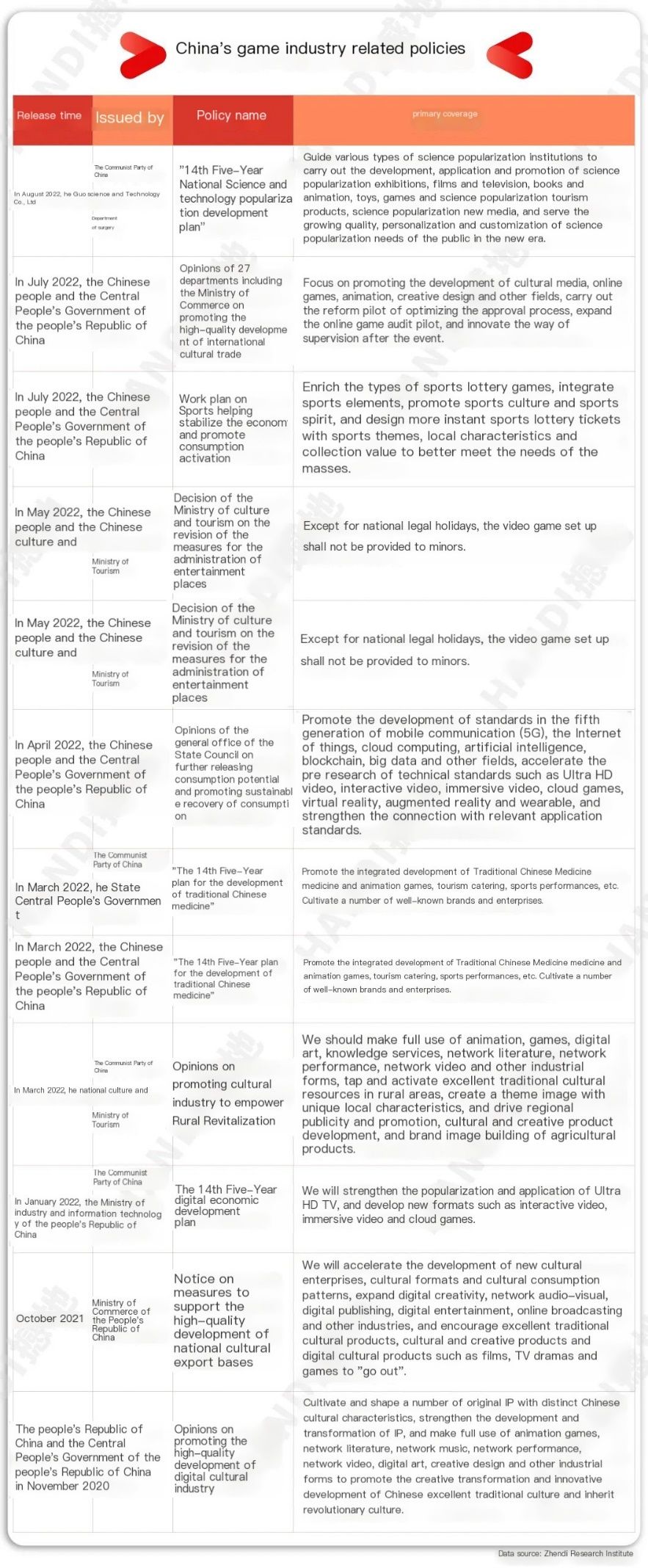

Since 2018, the game policy has mainly focused on the regulatory side, promoting the healthy development of the industry as the main theme, mainly including two main lines of version control and minors’ addiction, as well as game science popularization and application.

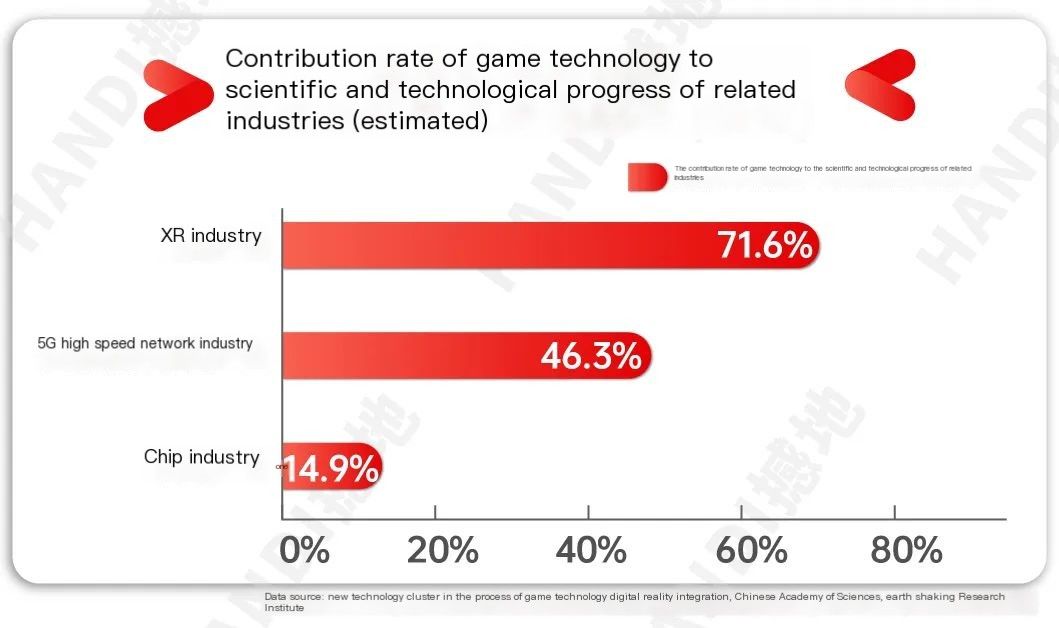

At present, the game technology power constantly promotes the development of the game industry, and the game technology helps 5G, chip industry, artificial intelligence and other advanced technologies. The spillover effect of game technology brings significant positive externalities to many technical fields, and becomes an important tool to promote the digital transformation of different industries, move towards digital integration, and build digital twins.

The social value of the game industry is gradually revealed, and the policy direction is also significantly warmer. The relevant departments in China have successively issued policies to support the development of the game industry. The game has become an industry of great significance for the national industrial layout and scientific and technological innovation.

Get more information tailored to your needs by click Here.